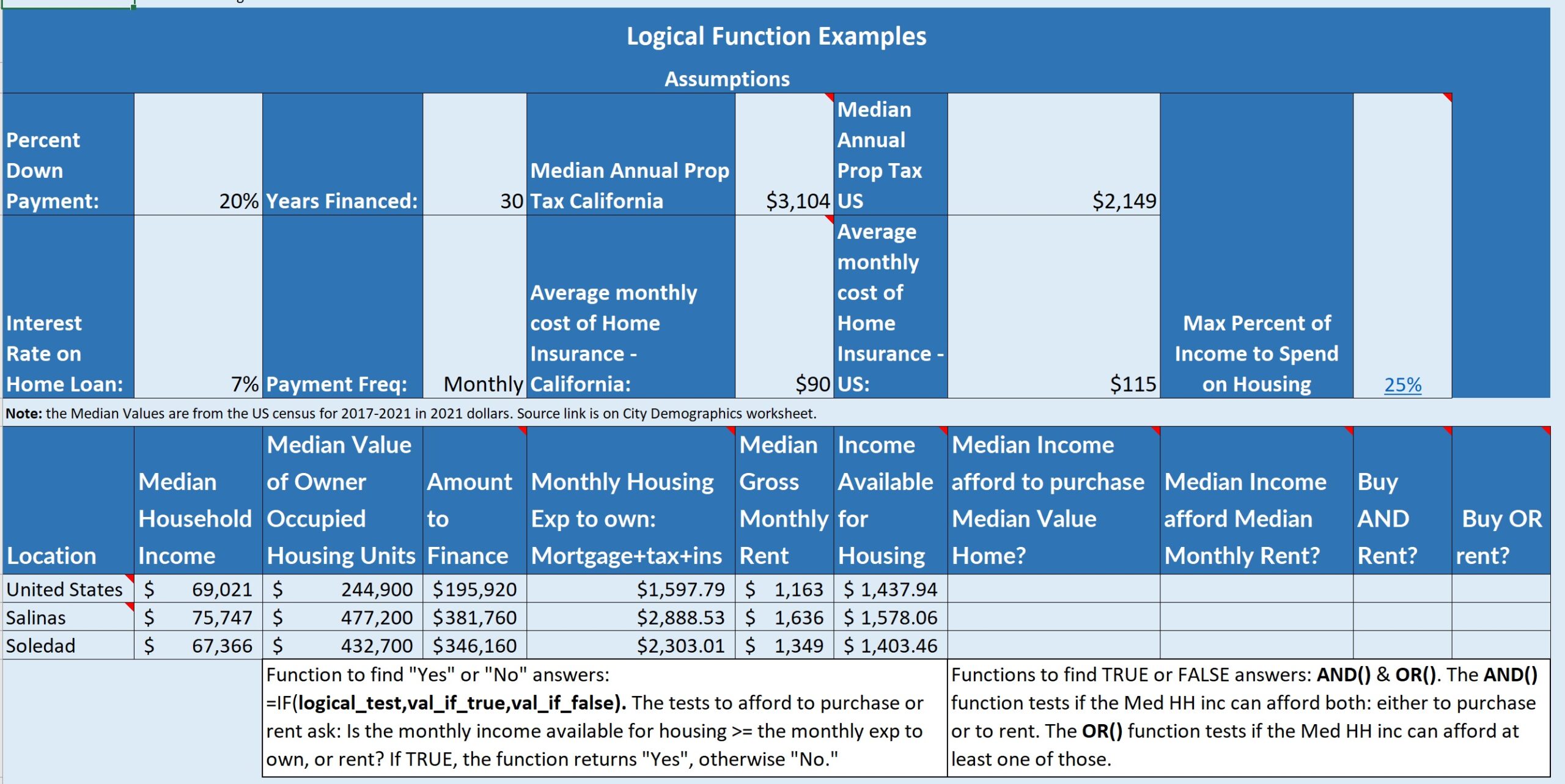

you earn the MEDIAN Household Income, at LEAST the MEDIAN Household Income, in your community, OR in the U.S. as a whole:

Can you afford to purchase a home that is priced at the MEDIAN value of owner occupied housing in your community, OR the U.S. as a whole? So we’ve got in this table, a column labeled Median Household Income for 2021, and Median Value of Owner Occupied Housing for 2021.

And if you’d like to examine the demographic data, there’s a table called City Demographics

that’s composed of values taken from the U.S Census Data through the period of 2017 to 2021, and then there’s values for the U.S. overall, that match these same categories. So we’ll go back to our What-If Analysis worksheet. In order to do this, ask this question, we have to come up with some assumptions to follow when we do our calculations. We’re going to assume that the prospective home buyer would put 20% down, that they would be able to get an interest rate of 6.5%,

they would pay monthly, they would finance for 30 years, and then we’re going to assume

Median Annual Property Tax values from another table that there’s a link to. You can go take a look at that information for California, for the communities in Monterey County, but then for the U.S as a whole, for the U.S calculations. And then we’ve got AVERAGE, instead of MEDIAN, AVERAGE monthly costs of home insurance, for a, basically a $250,000 value of home, for California, or for the U.S. So we’re going to apply, we’re going to include, the cost of insurance and property tax into what your monthly expenses would be for the housing, if you would purchase your home. And then, when we’re deciding whether you can afford it or not, we’re going to adhere to one set of advice’s recommendation, that one not spend more than 25% of one’s income on housing. So — I’ll step through the steps to get to the different values to use in our IF() Function. But what we’re going to come down to is asking the question: Can Median Income afford to purchase a Median Value Home? And we’re going to do apply that calculation to the U.S. as a whole, and to two different communities in Monterey County. Then we’re going to ask a separate question: Can Median Income afford to rent a Median Priced Monthly Rental,

be it home or apartment?

So let’s look at the different columns here. We’ve got Median Household Income, Median Value of Owner Occupied Housing, then the amount to finance: we’ll apply our assumption of 20% down and come up with the amount remaining after we subtract 20% from the value of the owner occupied housing.

Then, the monthly housing expense to own, we’re going to add the mortgage amount to the monthly tax and the monthly insurance. So we see in this formula we have a payment function to get our mortgage for the month. We’re dividing the annual property tax by 12. And then we’re adding in the monthly cost of home insurance. And keeping in mind that these estimates are in some cases not consistent values, because we’re using 2023 home insurance values, with 2021 property tax and property value values, and income values.

Then, since we’re also going to ask if one can afford to rent, we’ve looked up the Median Gross Monthly Rental values for the U.S. as a whole, and then for the different communities.

So we’re calculating the Income Available for Housing by taking

25%

over here in K4, of the value in column C, the Median Annual Income, 25% of that income, divided by 12. We’re saying that that provides the monthly amount available for housing.

So now we need an IF() Function to say, can we afford to purchase a home, and can we afford to rent our accommodations?

So, with our IF() Function: the Logical Test we will ask: Is the income that we have available for housing greater than or equal to (>=) the monthly housing expense to own a home?

If so, “Yes” we can afford it, else “No” we can’t.

And we can just drag this formula down the column, because none of these are absolute references, nor do they need to be.

But we do want to make sure wherever we needed them, we had absolute references. So it looks like we can’t afford to purchase a home, if we make a MEDIAN household income we can’t afford a MEDIAN priced home,

based on these assumptions: only spending 25% of our income on housing, and getting a 6.5% loan,

and paying over 30 years. Now, we could play around with these. We could agree that we were willing to put a higher percentage of our income towards our housing, we could hope to get a lower percent interest rate, and we could try to see if we could finance for 15 years,

although the the main thing that would get you would be a lower interest rate, that the payments wouldn’t be lower. Okay, so, can we afford to rent? Here we’re just going to compare

our Income Available for Housing,

is it greater than or equal to (>=) the Median Gross Monthly Rent?

If so, “Yes” we can afford it, else “No” we can’t.

So it looks like in the US as a whole, a household of Median Income CAN afford to RENT an accommodation at a monthly rental level, a Median Gross Monthly rent level. And Salinas, that income, the Median income, would NOT be enough. And Soledad that Median income WOULD be enough.

So doing a little What-If Analysis like this can be really useful in a lot of different

situations where you’re wondering, what does this look like? And what factors would I need to change in order to make this look more digestible? And you can always go back and do more research too, and say well is this really, is this really a meaningful question? If I have a Median Household Income

that’s just, that just means my income’s in the middle of all the incomes in this country. Doesn’t mean it’s the average income. And the median priced house, the same thing, it’s in the middle. It doesn’t mean it’s the average price. So this is just a little query to take a look at some interesting demographic data and exercise your IF() Function. Thank you.